Xn x Fitronics Industry Partner Highlight

Xn is a proud partner of Fitronics, the company behind the leading gym member experience software, TRP and sports course management software, CoursePro. Fitronics proudly supports thousands of sport and leisure facilities around the world, well respected and reputable for retaining members and motivating millions of adults and children to keep active through intelligent, effective, and user-friendly software solutions.

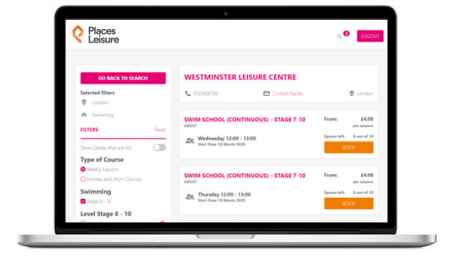

Part of the Jonas Group, Xn and Fitronics are sister companies with a partnership that takes two different forms. Fitronics’ TRP gym member experience software integrates with Xn Leisure, as well as many other leading member management systems, and pulls essential data such as member behaviour and attributes. This data is used to create and send automated emails, SMS communications, send surveys to gather feedback and further data, and measure member loyalty. As for CoursePro, Xn Leisure created a version of the software for their clients under the name ‘OnCourse’.

“This physically wouldn’t be possible without the integration we have with them”

— Sue Enright, Head of Product @ Fitronics

Xn Leisure and Fitronics’ technical teams work closely together to ensure integrations work well for all clients, collectively. In particular, the integration with TRP and Xn has enabled Fitronics to offer this software to Xn clients. This integration is vital as it ensures mutual customers can use TRP’s software to measure and improve their engagement, satisfaction, and member experiences.

Xn and Fitronics’ partnership is highly valued by both parties. It has allowed TRP to extract data from Xn Leisure and use it to power their member experience management solutions that benefit gyms, health and fitness clubs, and leisure centres by ensuring their members are happy and loyal. Sue Enright, Head of Product at Fitronics said: “This physically wouldn’t be possible without the integration we have with them.”

In terms of the future for Xn and Fitronics and their primary brands’ (TRP and CoursePro) goals, it is looking bright. Enright added, “Xn are currently in the process of moving their software suite from on-site hosted to the cloud. Our technical team is working closely with them to support this as OnCourse becomes a cloud-based system like CoursePro is, meaning OnCourse customers will soon have access to all the great features direct CoursePro customers do.”